Investing in Gold Ingots: A Comprehensive Guide

Gold ingots have long been a staple in the world of investing, highly sought after for their intrinsic value and stability. As an asset, gold has consistently proven to be a reliable hedge against inflation and economic uncertainty. In this comprehensive guide, we will explore why you should buy gold ingots, the benefits associated with this form of investment, and the best practices to ensure you make informed decisions when purchasing.

The Timeless Appeal of Gold

Gold is more than just a precious metal; it is a symbol of wealth, stability, and security. From ancient civilizations to modern economies, gold has held a place of reverence and importance. Here are some compelling reasons to consider gold as an investment:

- Inflation Hedge: As currencies lose purchasing power over time, gold tends to retain its value, making it an excellent hedge against inflation.

- Global Demand: Gold is prized in various industries, from jewelry making to technology, ensuring ongoing demand.

- Diversification: Investing in gold helps diversify your portfolio, reducing risks associated with stock market volatility.

- Historical Stability: Gold has maintained its purchasing power over centuries, making it a safe haven during economic downturns.

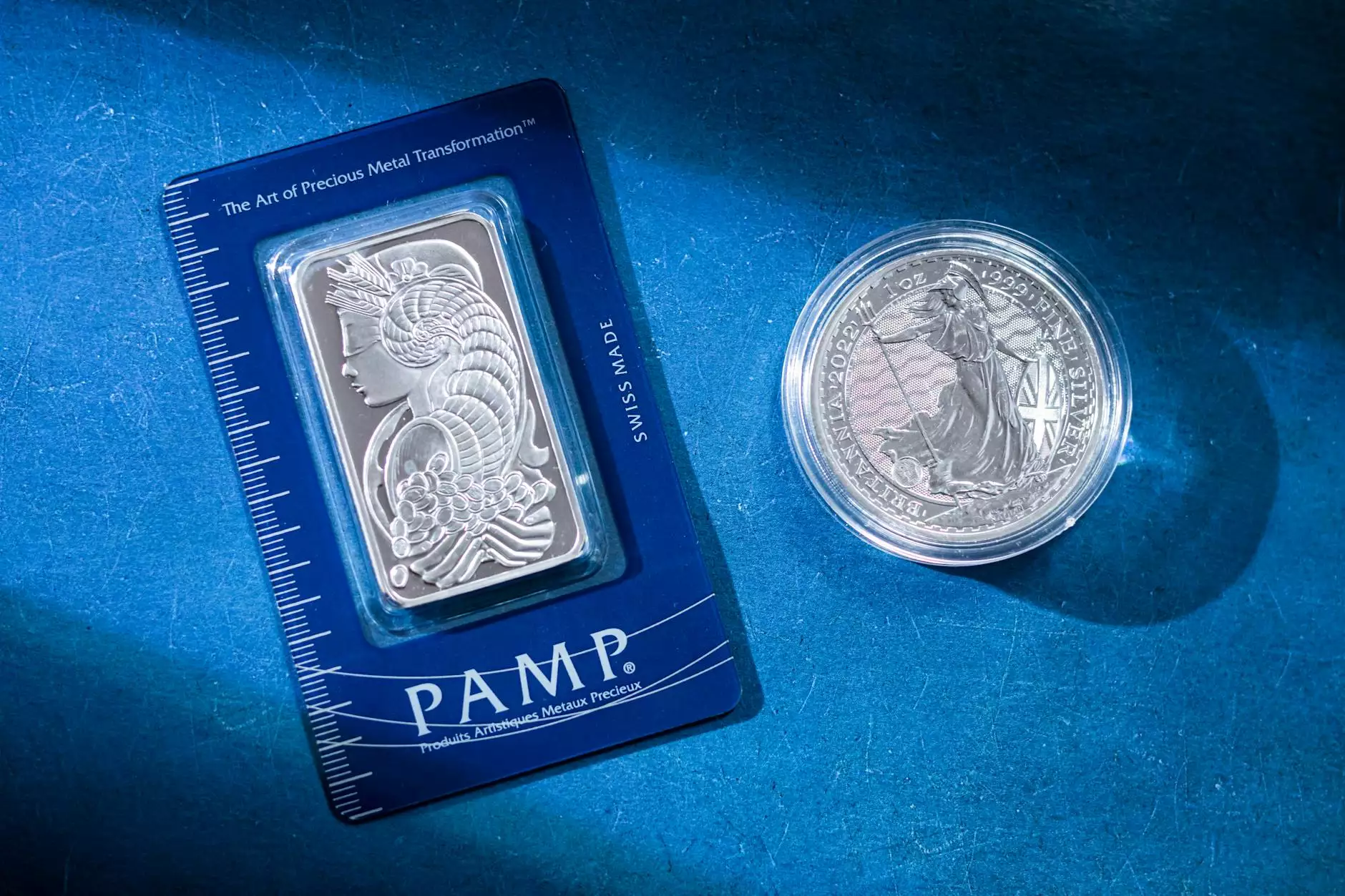

What are Gold Ingots?

Gold ingots are high-purity gold bars, typically produced by refineries and marked with assurance of weight and purity. They come in various weights, ranging from small 1-ounce bars to large 1-kilogram or 400-ounce bars. These bullion forms are often considered a more practical investment for serious investors or institutions looking to hold significant quantities of gold.

The Benefits of Buying Gold Ingots

Investing in gold ingots offers several benefits compared to other forms of gold investment, such as coins or jewelry. Here’s why you should consider adding them to your investment portfolio:

1. High Purity and Value

Gold ingots typically boast a purity level of 99.99%, meaning they contain very little to no impurities. This high purity translates to a more accurate investment as they are assessed based on their weight and the current market price of gold. The value of gold ingots is straightforward, which simplifies the buying and selling process.

2. Investment Security

The tangible nature of gold ingots offers a level of security that stocks and bonds cannot match. In times of crisis, physical gold can be a more reliable asset as it cannot be hacked, and its value is not dependent on digital systems or institutions.

3. Ease of Liquidation

Gold ingots are easier to sell than many other forms of gold, such as jewelry, which may require valuation and come with additional costs. Dealers and investors actively seek gold ingots, making them highly liquid assets that can be quickly converted back to cash.

4. Lower Premiums

Compared to buying gold coins or smaller gold pieces, ingots generally come with lower premiums over the spot price of gold. This means more of your investment goes into the actual value of the gold rather than markups.

How to Buy Gold Ingots

If you're convinced of the value of investing in gold ingots, here’s a step-by-step process to guide you through your purchasing journey:

Step 1: Research and Educate Yourself

Before making any purchase, it’s essential to educate yourself about the gold market and understand the factors that affect gold prices. Resources such as market analysis, price charts, and investment guides can provide insight into timing your purchases.

Step 2: Choose a Reputable Dealer

Finding a reliable distributor is crucial. Look for dealers with solid reputations, positive customer reviews, and transparent pricing structures. Websites like Dons Bullion offer a trustworthy platform to buy gold ingots.

Step 3: Assess the Purity and Weight

When purchasing gold ingots, always confirm their weight and purity. Authentic gold ingots will have a stamp indicating their purity (e.g., 999.9 fine gold). Don’t hesitate to ask the dealer for certificates or further verification.

Step 4: Understand Pricing and Premiums

Gold is priced based on market fluctuations. Ensure you understand the spot price of gold before purchasing and compare the premiums charged by different dealers. A better deal will generally mean a smaller premium relative to the spot price.

Step 5: Make Your Purchase Securely

For security, ensure you choose a method of payment that is reputable and offers buyer protection. Following your purchase, make arrangements for secure storage, whether that be a safe at home or a safety deposit box at a bank.

Storage and Security of Gold Ingots

After you purchase your gold ingots, it's crucial to store them securely to prevent loss, theft, or damage. Here are several storage options:

- Home Safes: Investing in a high-quality, fireproof safe can provide security at home.

- Bank Safety Deposit Boxes: Consider the safety deposit options in banks for added security.

- Professional Vaulting Services: Some companies specialize in storing precious metals and offer insured vault services.

Tax Implications of Buying Gold Ingots

Understanding the tax implications associated with buying gold ingots is crucial for planning and compliance. The taxation of gold varies by jurisdiction, so consider the following:

- Capital Gains Tax: When selling gold ingots, you may be subject to capital gains tax on profits made from the sale.

- Sales Tax: In some areas, buying gold may attract sales tax, so check local regulations.

- Tax Reporting: Always keep detailed records of your purchases and sales for accurate tax reporting.

Challenges and Considerations When Investing in Gold Ingots

While investing in gold ingots offers many advantages, there are challenges and considerations that potential investors should keep in mind:

1. Market Fluctuations

The price of gold can be volatile. It's essential to be prepared for price fluctuations and to have a long-term outlook when investing in gold ingots.

2. Storage Costs

Depending on your storage choice, there may be costs associated with securing your gold ingots. It's important to factor these into your overall investment budget.

3. Authenticity Verification

Always ensure the authenticity of your gold ingots when purchasing from dealers by seeking appropriate documentation and using reputable sources.

Conclusion

Investing in gold ingots is a strategic move that offers numerous benefits for both novice and experienced investors. With their tangible value, liquidity, and potential for long-term gains, gold ingots can play a crucial role in any comprehensive investment strategy. By following the steps outlined in this guide and purchasing from reputable dealers like Dons Bullion, you can secure a stable investment that withstands the tests of time. Take charge of your financial future by considering adding gold ingots to your investment portfolio today!

For more information on buying gold ingots, visit Dons Bullion for expert advice and exclusive offers.