Basic Bookkeeping for Small Business: A Comprehensive Guide

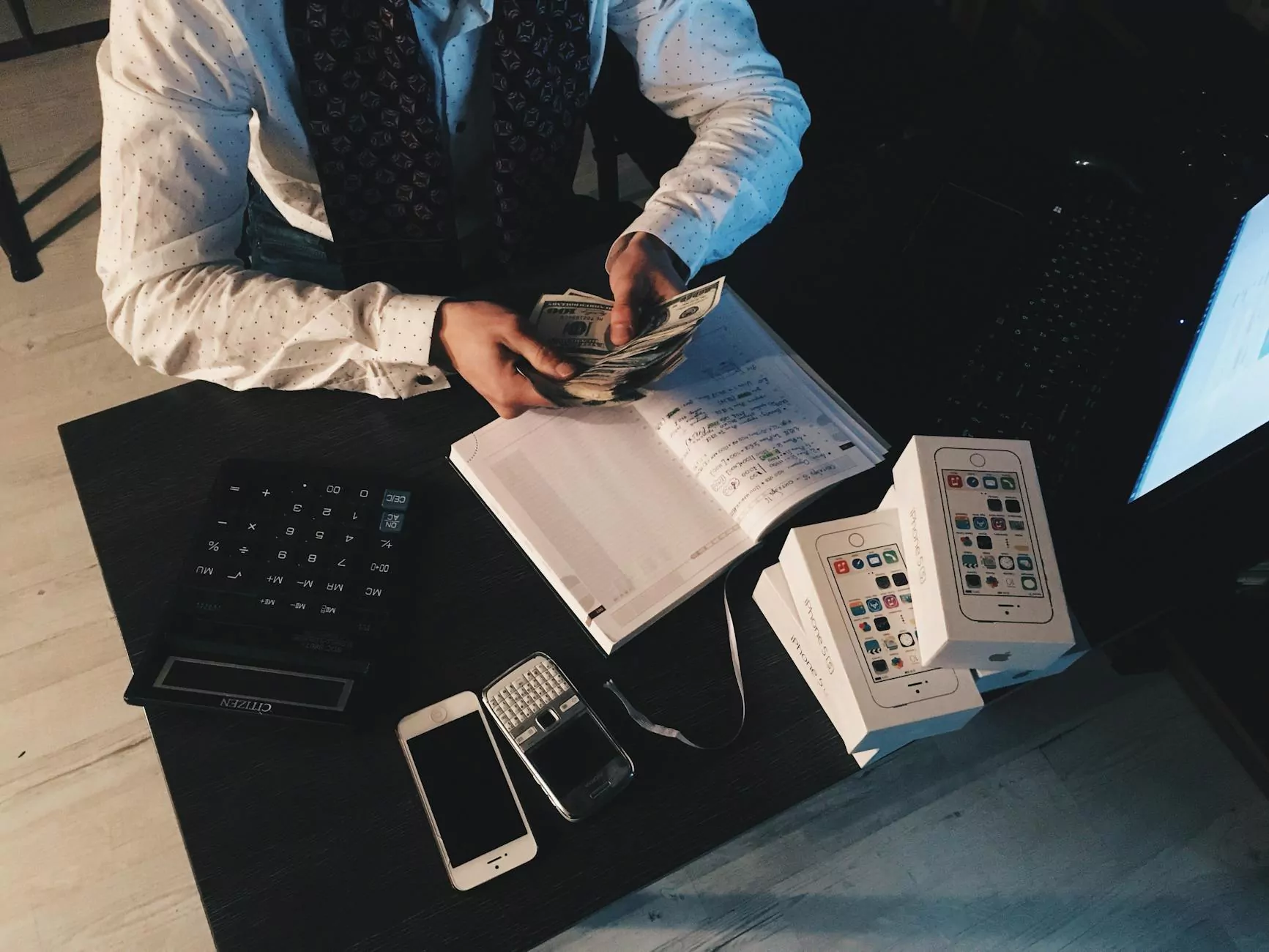

When it comes to running a successful small business, understanding basic bookkeeping is essential. Bookkeeping is not just about keeping track of your finances; it is the foundation on which your business can thrive. From managing cash flow to preparing for taxes, effective bookkeeping practices can be the difference between success and failure.

What is Bookkeeping?

Bookkeeping is the systematic recording of financial transactions across various stages of a business. Every purchase, sale, payment, and receipt is recorded in the books of accounts, making bookkeeping critical for small businesses. Here’s why:

- Financial Accuracy: Ensures that all financial records are accurate.

- Business Analysis: Helps in analyzing performance through profit and loss statements.

- Tax Preparation: Facilitates easier tax filing and compliance.

- Cash Flow Management: Monitors the cash flow to ensure you have enough to cover expenses.

The Importance of Basic Bookkeeping for Small Business

Let’s delve deeper into why basic bookkeeping is crucial for the sustainability of small businesses.

1. Enhances Financial Control

Maintaining accurate financial records is the cornerstone of sound financial control. When you keep track of every transaction, you gain better insight into your spending habits, revenue streams, and opportunity costs. This data can be used for informed decision-making.

2. Aids in Performance Measurement

Bookkeeping allows you to create financial statements like income statements and balance sheets. These documents are essential for assessing the health of your business. You can measure profits against losses and adjust your strategies accordingly.

3. Streamlines Tax Preparation

For small business owners, tax season can be a source of significant stress. With organized records, filing taxes becomes simpler and faster. You can ensure that you do not miss any deductions, potentially saving you money.

4. Improves Cash Flow Management

Understanding your cash flow is vital for maintaining operations. Bookkeeping helps keep track of accounts receivable and accounts payable, allowing you to manage your cash more effectively.

Key Components of Basic Bookkeeping

Implementing effective bookkeeping involves several key components:

1. Recording Transactions

Every financial transaction should be documented. Whether it’s sales, expenses, or investments, recordings should be made promptly to maintain accuracy.

2. Ledger Maintenance

A general ledger is the backbone of your accounting system. In it, all transactions are categorized into different accounts. Maintaining this ledger with precision helps in tracking all financial states of your business.

3. Financial Statements Preparation

Creating financial statements such as the balance sheet, income statement, and cash flow statement provides a snapshot of the business’s financial health. Regularly reviewing these documents helps identify trends in your business.

4. Budgeting

Basic bookkeeping allows you to create budgets based on historical data. A well-defined budget can guide your spending and help identify areas for cost savings.

How to Implement Basic Bookkeeping for Your Small Business

Here are detailed steps to implement effective bookkeeping in your small business:

Step 1: Choose a Bookkeeping Method

There are two primary methods of bookkeeping:

- Single-Entry Bookkeeping: Best suited for small businesses with few transactions. Each transaction is recorded once.

- Double-Entry Bookkeeping: More complex but offers a complete view of all accounts. Each transaction affects two accounts, enhancing accuracy.

Step 2: Get the Right Tools

Invest in accounting software that caters to your business needs. Some popular options for small businesses include:

- QuickBooks

- Xero

- FreshBooks

These platforms offer features suitable for tracking income, expenses, invoicing, and more.

Step 3: Set Up a Chart of Accounts

A chart of accounts categorizes all financial transactions. This tailored list helps in organizing information and ensuring that all financial data is accounted for.

Step 4: Record Transactions Regularly

Consistency is key in bookkeeping. Set a schedule to record all transactions weekly or monthly to minimize errors and avoid falling behind.

Step 5: Reconcile Your Books

Regularly compare your records with bank statements and other financial statements to ensure accuracy. This step helps catch errors early and maintains the integrity of financial data.

Step 6: Seek Professional Help

If bookkeeping becomes overwhelming, consider hiring a professional accountant or a bookkeeper. This investment can lead to significant time savings and peace of mind.

Common Bookkeeping Mistakes to Avoid

Even the smallest oversight can lead to larger problems. Here are common mistakes to watch out for:

- Neglecting Receipts: Always keep receipts to support your transactions and deductions.

- Mixing Personal and Business Finances: Keep separate accounts to avoid confusion.

- Failing to Reconcile Monthly: Regular reconciliation is essential for maintaining accuracy.

- Ignoring Financial Statements: Regularly review your financial statements for anomalies.

The Benefits of Outsourcing Bookkeeping

Outsourcing your bookkeeping can have several advantages:

1. Expertise

Outsourcing gives you access to professionals who specialize in bookkeeping, ensuring your records are accurate.

2. Time Savings

By outsourcing, you can focus on growing your business instead of worrying about financial records.

3. Cost-Effectiveness

Often, outsourcing bookkeeping can be more economical than hiring a full-time employee.

Conclusion: Mastering Basic Bookkeeping for Your Small Business

Comprehending basic bookkeeping for small business is not merely an option; it is a necessity for success. With the appropriate tools, processes, and mindset, any small business can establish a strong financial footing and be positioned for growth. Whether you tackle bookkeeping yourself or choose to outsource it, developing a solid understanding will empower you as a business owner.

Take action today by implementing these basic bookkeeping tips, ensuring your small business thrives in a competitive landscape. Remember, precise financial management is your gateway to strategic growth!